HELOC Overview

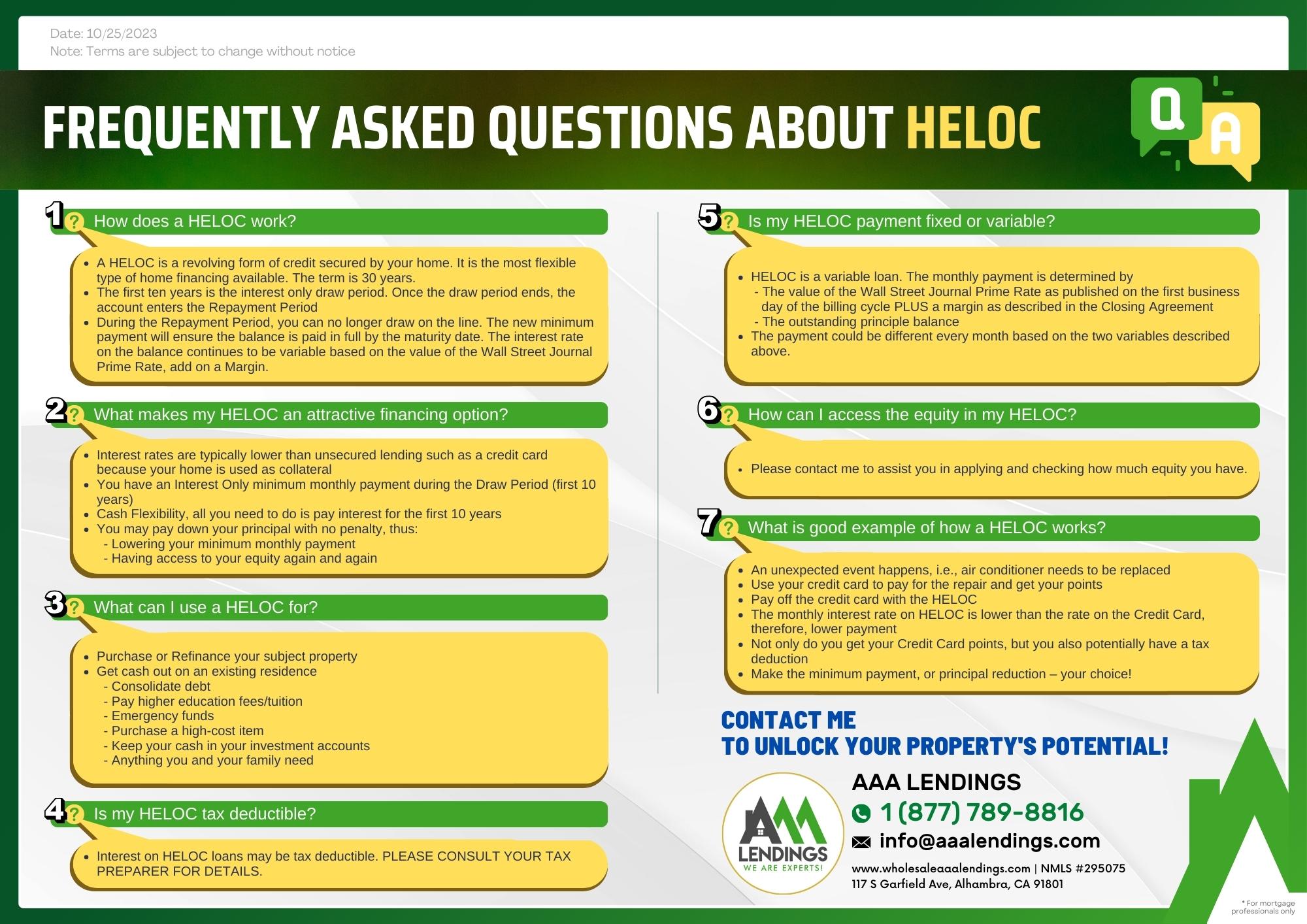

The HELOC program is Home Equity Line Of Credit.

Index + Margin. 30 Years term, 10 Yrs I/O Draw Period followed by 20 Years Amortization.

Rate: CLICK HERE

* Index: Prime Mortgage Rate floated with the market.

Margin: Subject to loan scenarios.

HELOC Program Highlights

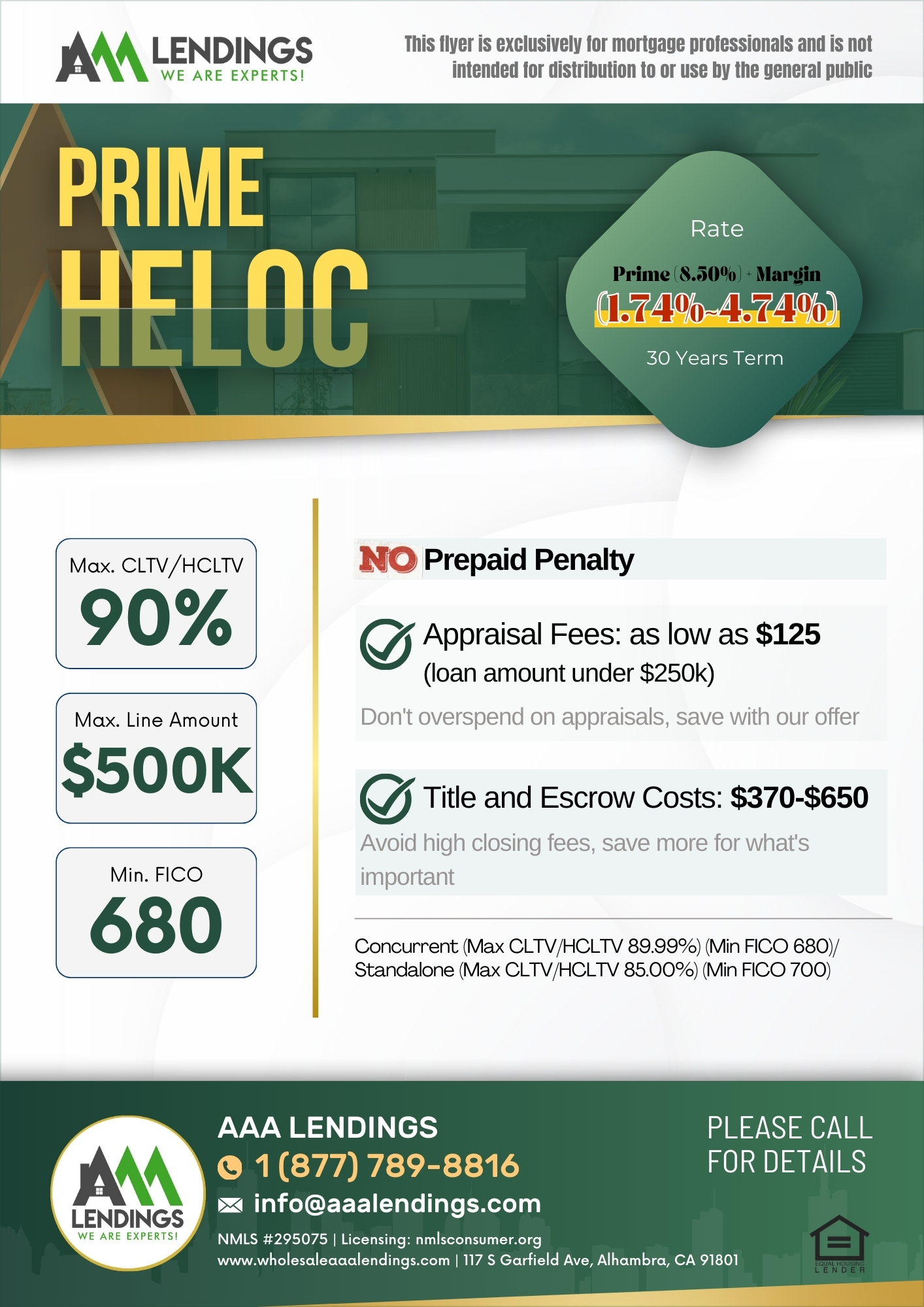

Prime HELOC

1) No Prepaid Penalty;

2) Title and Escrow Closing Fee $370-$650 (Closing with Title Company Designated by AAA LENDINGS);

3) Max. HCLTV/CLTV 89.99%;

4) Line Amount $50,000-$500,000;

5) Min. FICO 680.

Concurrent (Max CLTV/HCLTV 89.99%)(Min FICO 680)/Standalone(Max CLTV/HCLTV 85.00%)(Min FICO 700)

Max Line Amount $500,000

Investment Ineligible

Primary Home(Concurrent Max CLTV/HCLTV 89.99%)(Standalone Max CLTV/HCLTV 85.00%)

Second Home(Concurrent Max CLTV/HCLTV 80.00%)(Standalone Max CLTV/HCLTV 80.00%)

Allow to charge max point and fee: $1,250.

Expanded HELOC

1) No Annual fee;

2) No Prepaid Penalty;

3) Primary & Second home are eligible;

4) Max. CLTV/HCLTV 89.99%;

5) Max. Loan Amount $350,000;

6) Min. FICO 680.