Navigating Full Doc Jumbo Loans: The Critical Role of Managing Mortgage Late Payments

Introduction

In the ever-evolving landscape of real estate financing, Full Doc Jumbo loans have become a vital tool for purchasing high-value properties, especially in high-cost areas like California. As these loans accommodate the financing needs for properties beyond conventional conforming loan limits, understanding their nuances, particularly the implications of mortgage late payments, is crucial for potential borrowers.

Understanding Full Doc Jumbo Loans

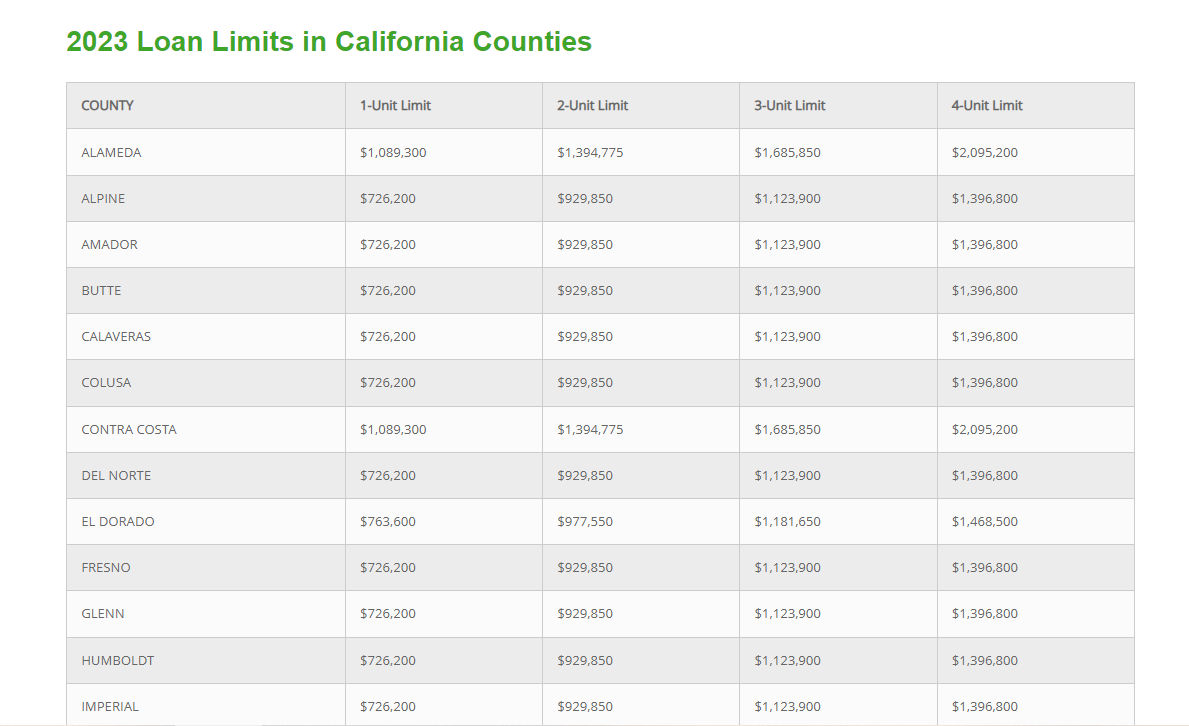

Full Doc Jumbo loans are designed for real estate purchases that exceed the loan limits set by government-sponsored entities. In 2023, areas like Alameda County in California have seen these limits reach as high as $1,089,300 for a single-unit property. These loans are indispensable in markets where luxury homes and high property values are the norms.

2023 Loan Limits in California Counties

The rising real estate values in California have led to increased loan limits in counties such as Alameda, reflecting the growing need for Full Doc Jumbo loans. These loans fill the gap for financing properties that surpass the heightened limits, ensuring that borrowers have access to necessary funds.

The Impact of Mortgage Late Payments

One of the most critical factors in securing a Full Doc Jumbo loan is the borrower’s history of mortgage payments. Late payments can significantly impact a borrower’s credit history and influence the loan terms offered by lenders. A record free of mortgage late payments is seen as a sign of financial reliability and can lead to more favorable loan conditions.

Loan Approval Process

The process of securing a Full Doc Jumbo loan involves stringent scrutiny of the borrower’s financial background. Lenders require detailed documentation of income, assets, and credit history. A history of mortgage late payments can be a major obstacle, necessitating additional steps to demonstrate creditworthiness.

Interest Rates and Mortgage Late Payments

Interest rates on Full Doc Jumbo loans are closely tied to the borrower’s credit history. Late payments can lead to higher interest rates, as lenders perceive them as an increased risk. Maintaining a record free of late payments is therefore essential for securing competitive interest rates.

Managing Mortgage Late Payments

To avoid the pitfalls of late payments, borrowers should employ strategies like budgeting, setting up automatic payments, and building an emergency fund. These practices ensure timely payments and help maintain a healthy credit score, crucial for favorable loan terms.

Refinancing Options

For those with Full Doc Jumbo loans, refinancing can be a viable strategy, especially if they have improved their credit scores or stabilized their financial situation after a history of mortgage late payments. Successful refinancing can result in lower interest rates and more manageable monthly payments.

Expert Advice and Consultation

Given the complexities of Full Doc Jumbo loans, seeking advice from mortgage experts is highly recommended. These professionals can guide borrowers through the intricacies of these loans, especially in navigating issues like mortgage late payments.

Conclusion

Full Doc Jumbo loans are indispensable in high-value real estate markets, offering opportunities to finance luxury properties. However, managing financial commitments, particularly avoiding mortgage late payments, is crucial. By understanding market dynamics, maintaining a strong payment history, and seeking expert advice, borrowers can effectively leverage these loans to realize their real estate goals.

Video: Navigating Full Doc Jumbo Loans: The Critical Role of Managing Mortgage Late Payments

Post time: Dec-04-2023